The creation of an investment portfolio in conjunction with the trade portfolio, held by Liberal Party Minister Andrew Robb, therefore provided reassurance that the new government was not going to abandon Australia’s long-standing proactive approach to encouraging foreign investment.

Yet uncertainties remained as one of the early decisions made by the Australian Treasurer was a rare use of his powers to block a major foreign investment proposal — in this case, the takeover of Grain Corp by American company Archer Daniels Midland. The National Party leadership, representing rural constituencies, also continued its hostility towards foreign investment in agribusiness.

Foreign investment brings much needed capital, expertise, technology and links to international markets. Maintaining an open investment regime and an attractive investment environment is essential to growth in jobs and maintaining living standards. For almost two centuries, it has been an important engine of Australia’s economic progress.

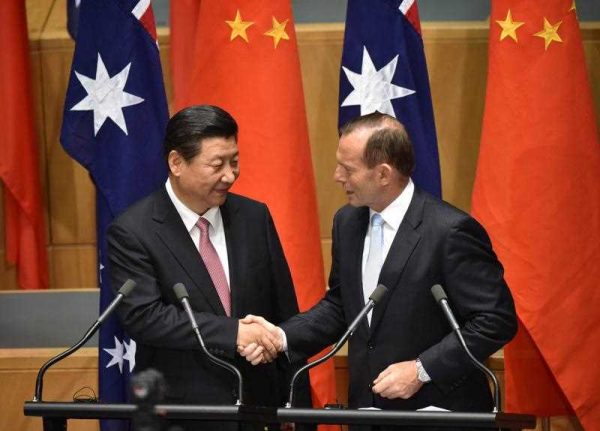

Australia has historically been an attractive destination for investment. The world’s major investors, such as Europe, the United States and Japan, are also Australia’s largest sources of direct foreign investment. Now it has emerged as a global investor, China is also becoming a major investment partner, and Australia is one of China’s largest ultimate destinations for foreign investment.

The Foreign Investment Review Board (FIRB) and the foreign investment regime have played an important role in facilitating investment and reassuring the Australian community about the value that foreign investment brings, through screening foreign investment to ensure new investment is in the national interest.

Two recent developments have led to pressure on the approach to foreign investment policy. First, the large inflow of investment from China associated with the resources boom put stress on the screening process and resulted in short term policy responses because of political pressures. Community concerns arose in response to the rapid increase in the scale of Chinese investment and its unfamiliarity as a new source of investment, the complication of high levels of state ownership, and the expansion of Chinese investors into agriculture and real estate. The increased interest in investment in agribusiness more generally has elevated anxieties about foreign investment in rural assets.

Second, free trade agreements have de facto amended the foreign investment regime by raising the monetary thresholds that trigger a review of investments originating in particular countries and introduced distortions in the treatment of foreign investment from different countries. Investment from Europe, Southeast Asia and all other countries is treated differently from investment from the United States, New Zealand, Chile, China, South Korea and Japan with which preferential trade agreements have been signed. This does not make any policy sense.

The Australian Treasury is undertaking a welcome review of foreign investment laws and regulations aimed at modernising and simplifying the foreign investment regime. This will tidy up a number of legislative anomalies and regulatory processes that make it more difficult for productive investment from abroad to contribute to the strength and resilience of the Australian economy.

In this week’s lead essay, John Denton and I argue that the time is right for a fundamental re-positioning of the foreign investment regime.

There is considerable evidence that Australia’s standing in the international investment community has been diminished in recent years by short-term politically-driven responses in foreign investment policy making. Piecemeal changes that discriminate among different investment source countries have weakened the coherence of the regime and go against international best practice as outlined in frameworks such as the OECD’s Policy Framework for Investment, which recommends non-discrimination as a guiding principle of investment policy. Large investors, like the United States and China, see Australia’s foreign investment regime as a barrier to foreign investment rather than a facilitator that guarantees the strongest possible flow of foreign investment in the national interest.

With the creation of a ministry responsible for attracting foreign investment, the current Australian government has taken a first step in re-positioning to project the national interest in a more clearly supportive foreign investment regime.

As Denton and I point out, there is a great deal of evidence that trade and foreign investment are inextricably linked. The OECD identifies a direct correlation between trade and foreign investment. It recommends close interaction between governmental departments to ensure capitalisation of the benefits of trade-inducing foreign investment.

Specifically we suggest the launch of ‘an inter-departmental effort comprising importantly the Treasury and Trade and Investment ministries to look at the macro policy issues relating to foreign investment and actively attend to the intersections between trade and foreign investment policy’. An inter-departmental committee could serve a Ministerial-level Foreign Investment Council chaired by the Treasurer and including the Trade and Investment Minister. ‘It would not consider the merits or national interest issues for individual foreign investment proposals which would remain the province of the Treasurer under the Foreign Investment Review Board’. But the Foreign Investment Council and its inter-departmental advisors would be responsible for ensuring Australia crafted a consistent trade and foreign investment policy with the clear message that foreign investment is welcome. At the same time it would broadcast Australia’s expectations of foreign investment, including the importance of conformance with domestic regulatory institutions, such as the Australian Competition and Consumer Commission (ACCC), the Australian Securities and Investments Commission (ASIC), the Australian Taxation Office (ATO) and environmental agencies, in the governance of foreign investments (which apply equally to domestic investments).

‘The attractiveness of Australia as an investment destination is not simply a matter of elevating investment promotion by Austrade and DFAT’, we argue, ‘but also requires active engagement of the investment policy makers with authorities and business in important target countries, such as China and India, and its proper resourcing’.

An Australian Foreign Investment Council, with input from across the relevant ministries and agencies, would help to address these problems and project more effectively Australia’s strategic interests in this area of its international economic diplomacy.

Peter Drysdale is Editor of the East Asia Forum.

These recommendations are outlined in further detail in an EABER Working Paper, ‘Australia’s Foreign Investment Regime and the Need for Reform’, available here.