On 26 February 2024, the Tokyo Stock Exchange (TSE) published the Revision of the Listing Rules in Order to Expand English Disclosure in the Prime Market. From April 2025, firms listed on the TSE’s Prime Market will be obliged to disclose material corporate information, financial results and ‘timely disclosure information’ in both Japanese and English.

The Prime Market is a platform for Japanese firms that focus on constructive dialogue with global investors. While there has already been some progress in English disclosure, partly because of 2021 revisions to the Japanese Corporate Governance Code, overseas investors still remark that there are differences in the volume of information and timing of Japanese and English disclosures. Critics claim that differences of this nature constrain investments. As such, it is crucial that Japanese firms enhance the quantity and timing of their English disclosures to attract more foreign investment and increase their value through constructive dialogue.

Many firms listed on the Prime Market are already rigorously expanding their businesses globally. According to the Cabinet Office’s Annual Survey of Corporate Behaviour, the ratio of overseas production in the manufacturing sector is over 20 per cent.

The Japan Exchange Group, including TSE, revealed that the shareholding of Japanese firms by foreign investors reached around 30 per cent at the end of the 2022 financial year, underscoring the importance of foreign investors in the Japanese stock market.

Under these circumstances, discrepancies in the quality of English and Japanese disclosures of corporate management information are unacceptable.

Rapid advances in AI technologies will lower the language barrier when it is just a matter of translating Japanese information into English. Still, there remains another hurdle. The logic of persuasion in the anglophone world seems different from that of the Japanophone world. Even a perfect draft in Japanese might not be as remarkable in English, though understandable. The sequence of ideas expressed in translated texts should adhere to global standards and it is all the same for English disclosures of corporate management information.

The TSE’s 2024 revision calls for enhanced English-language disclosures from Prime Market listed firms that have already globalised. As of 22 May 2024, this accounts for 1648 of the 3936 firms on the TSE. This should have a positive effect on the management of globalised firms, connecting them further with their investors. Still, improved communication with stakeholders should also be an ambition of not yet globalised firms that are aiming for rapid growth in the coming years.

Just as is the case elsewhere, unlisted Japanese firms struggle to attract funds through international equities. Most start-ups have to rely on domestic funding to kickstart their project. Yet, to grow further after being listing on the Japanese stock market, it becomes increasingly necessary for Japanese firms to globalise not only their demand but also their fundraising.

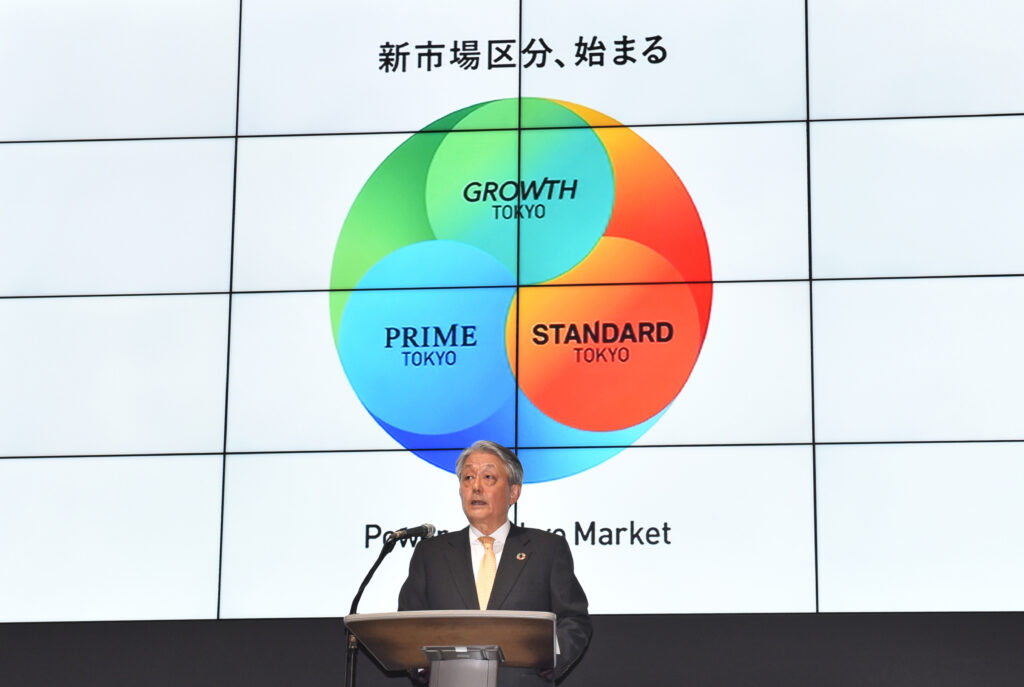

In Japan, new firms often list in the Growth Market — a platform for companies with high growth potential. Of the 3936 firms on the TSE, 581 firms are currently listed on the Growth Market. Their high hope may be to be listed on the Prime Market, which they can do when their equities are sufficiently liquid and their management is adequately governed.

It is often remarked that Japanese start-ups have so far failed to grow to be listed in the Primary Market. If Japanese start-ups are to keep pace with their international counterparts, they must globalise their corporate management and attract a wide range of investors. Correct communication in English will be indispensable in this context.

Efforts by Prime Market-listed firms to disclose important managerial information in Japanese and English — without any difference in quality — will be just a first step. As the Japanese population further declines, domestic economic activities will also shrink. In this context, Japanese growth-seeking firms should expand their management scope internationally.

Diversified stakeholders, including foreign investors, engaging in constructive conversations with Japanese firms could contribute to enhancing their corporate value. This would be a great help for the younger generation in asset building. Financial asset building is even more important for younger generations today under the rapidly ageing society, as they need to prepare for retirement.

Better disclosure of the management information of Japanese firms in English seems an indispensable step, not only for globally-acting Japanese firms and global investors, but also for Japanese start-ups and the younger generation.

Takashi Kozu is Visiting Researcher at the Australia-Japan Research Centre, The Australian National University and Chief Executive Officer of the Securities Analysts Association of Japan.