Amid China’s evolving economic landscape, the decision to cancel the premier’s 2024 press conference — traditionally held during the Two Sessions for over thirty years — has raised eyebrows and stirred discussions among international observers, analysts and investors.

This deviation from longstanding tradition has led many, especially in Western media, to speculate that the window to gain insights into China’s economic policy shifts might be closed. Analysts and investors, who rely on these press conferences to decipher the trajectory of China’s economic development, will now find it quite difficult to grasp China’s economic policies for 2024.

The discontinuation of the premier’s press conference may be interpreted as an indication of the Chinese leadership’s confidence in their current information disclosure practices. This year’s Two Sessions featured an integrated approach to presenting the government work report, the plan report and the budget report, alongside press events focused on the economy and public welfare. This signifies a strategic shift to a ‘diversified, procedural and standardised’ information-sharing approach. It implies the Chinese government is exploring new communication methods for economic policies, despite criticisms of reduced transparency.

This new normal requires an enormous amount of expertise to navigate. Yet the absence of the premier’s press conference does not preclude the possibility of understanding China’s economic direction. Through analysis of publicly available information, it is still possible to glean insights and address critical questions concerning China’s economic direction.

In 2024, Chinese policymakers plan to elevate household consumption while focusing on substantial investment in high-tech industries. Two important but overlooked statements — ‘synchronisation of residents’ income growth with economic progression’ and the pursuit of ‘a basic equilibrium in the balance of payments’ — deserve special attention.

The year-on-year expansion of nominal per capita disposable income, in tandem with GDP growth, underlines the goal to enhance household consumption. But with the ratio of consumption expenditure to disposable income probably stabilising around 66 per cent — similar to the previous year but higher than from 2020 to 2022 — it implies that the consumption share of GDP will likely stay unchanged in 2024.

A basic equilibrium in the balance of payments signifies a minimal current account surplus and suggests the overall trade balance will likely show a decreasing surplus this year.

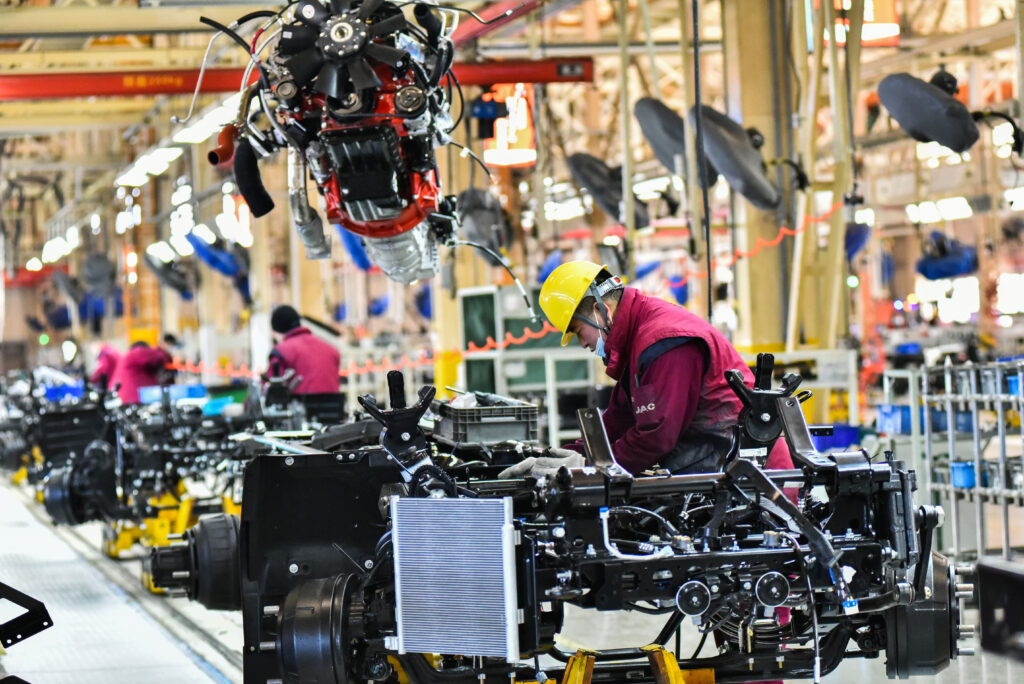

Investment, especially in ‘new quality productive forces’, is poised to be essential for realising the targeted five per cent GDP growth for 2024. Amid concerns of high local government debt, prioritising ‘new quality’ sectors — hydrogen energy, new materials, biomanufacturing and supercomputing — reflects a focus on innovation and total factor productivity improvement to drive economic growth.

To support investment in these new quality productive forces, apart from government funding such as government bonds, Chinese policymakers are encouraging ‘social capital’ like venture capital and equity investments. This strategy highlights a multifaceted approach to financing innovation, aiming to diversify the sources of investment and stimulate private sector participation in the development of cutting-edge technologies.

Research and development, the lifeblood of innovation, typically requires extensive economic and human resources. It is a long-term endeavour with inherent uncertainty and risk of failure. The government work report acknowledges this challenge and has outlined a strategy to accelerate the development of these ‘new quality’ sectors. It proposes not only to fast-track innovation but also to cultivate an ecosystem conducive to the growth of ‘emerging and future’ industries. This approach indicates a broader policy orientation that seeks to leverage industrial policy tools, including active fiscal incentives and structural monetary measures.

Effective industrial policies, with a focus on nurturing new quality productive forces, have the potential to catalyse domestic economic growth in China, delivering widespread benefits to its populace and contributing to global economic stability.

Yet without institutional reforms, achieving productive investment and enhanced total factor productivity becomes extremely difficult, and economic growth cannot be sustained. Worse, the use of industrial policies has already increased global strategic and technological competition. Without thoughtful institutional reforms, the surge in capital investment may precipitate overcapacity and a salient increase in exports in certain areas, such as electric vehicles.

Though Chinese policymakers have expressed willingness to import more products from the European Union and open their doors wider to US and European investments through relaxed market restrictions, the existing institutional deficiency risks exacerbating trade tensions. This could lead to more trade wars on the international stage in the foreseeable future.

To move forward from the Two Sessions, Beijing needs to implement robust accountability mechanisms to curb overinvestment and strengthen support for innovation through enhanced intellectual property protection. Equally as important, China must engage in international coordination and cooperation, fostering a truly sustainable, innovation-driven domestic economy and mitigating potential conflicts in global industrial competition.

Yuhan Zhang is a Political Economist based at UC Berkeley and Adjunct Assistant Professor at the G20 Center of Beijing Foreign Studies University’s International Business School. He also runs the China’s Economy and the World blog.

China's discontinuation of the premier's press conference, a key platform for insights into its economic policies, signals a shift to a more diversified and standardised approach in presenting policy information. While this represents a challenge, analysis of existing documents reveals a strategy for 2024 focused on elevating household consumption and significant investments in high-tech industries. This involves leveraging industrial policy tools and international cooperation to stimulate economic growth and mitigate potential global industrial conflicts.