Both seek to limit the presence of the West, particularly any Western military activity, in their immediate backyards — Eastern Europe for Russia, the South China Sea for China and Central Asia for both.

After Russia’s rift with the West over Ukraine, isolation pushed Moscow even closer to Beijing. But their relationship is marked by historic insecurity and mistrust that only deepens as the imbalance of power between Beijing and Moscow grows. This dynamic is particularly seen in Central Asia, where Chinese economic, political and soft power is shifting the geopolitical landscape.

Chinese trade with the five Central Asian states ballooned over the past decade, exceeding US$30 billion in 2016, a figure that dwarfs Russia’s US$18 billion. Despite the hype about a new ‘great game’ between Russia and Europe in Eurasia, it was China — not the West — that broke Russia’s monopoly over Central Asia’s oil and gas exports. China’s clout continues to grow with the Belt and Road Initiative (BRI), President Xi Jinping’s vast vision to build transportation infrastructure across Eurasia to support his country’s export flows. BRI is a highly ambitious scheme, albeit one with lingering questions over its economic viability. Even if partially fulfilled, it will reduce Russia’s hold over Central Asia’s export routes.

Central Asian leaders warmly embrace the BRI, hoping it will jumpstart stagnating economies, enhance socioeconomic stability and bring an influx of follow-on investment. Kazakhstan stands to benefit most from BRI given its geographic location as the key transit state. It welcomes China’s engagement as a way to help modernise ageing infrastructure and diversify its economy. It is also using growing Chinese investment to signal to Russia that it has options and that any attempt by the Kremlin to replicate a Ukraine scenario in Kazakhstan, a country with a large ethnic Russian population, could not go ahead without running into China.

Russia seems unconcerned about China’s economic dominance of Central Asia or regional leaders’ embrace of Beijing. Moscow knows it can do little about China’s presence. Russia’s stagnant economy limits its ability to compete with China. And Russia’s growing economic and diplomatic dependence on Beijing in the post-Ukraine sanctions era limits Moscow’s ability to push back.

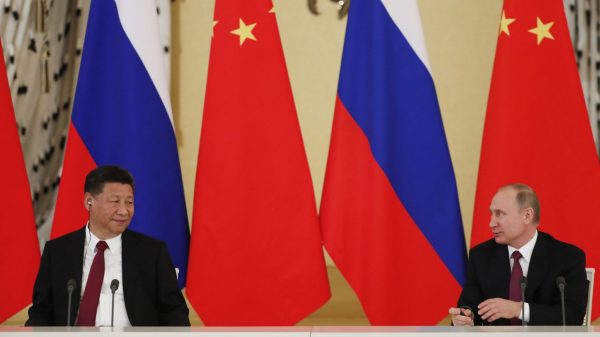

Unlike former US president Barack Obama, who famously dismissed Russia as a ‘regional’ power, President Xi recognises Russian President Vladimir Putin’s desire to be taken seriously as a global leader. To keep public frictions to a minimum, Xi offers Putin multiple summits per year. Often they end with vague promises to coordinate BRI with Russia’s Eurasian Economic Union initiative (EEU).

But these promises are unlikely to be realised because the BRI and EEU are incompatible. BRI is a vision to connect multiple markets and reorient global trade with China as its engine. The EEU is an effort to create a single closed market that is dominated by Russia to enhance Moscow’s influence in the region in the face of continued encroachments from both Europe and China. With limited resources and a heavy political hand in the region, Russia is a much less attractive option than China. Compared to Beijing’s inclusive BRI framework, the EEU is an unhappy union of coerced members and frequent trade spats.

Aware of Russian sensitivities about China’s growing power, Beijing smartly refrains from voicing any plans to develop a hard security footprint in the region. It has traditionally left that to Russia and instead pushes its role as a ‘soft’ security provider — one that brings security through economic investment. But China is now signalling it wants to play a more active security role in the region. Central Asia is the last buffer between it and the instability that is rocking much of the Muslim world at a time when Russia’s security sector is stretched thin by multiple military conflicts.

China is reportedly building a military base on the Tajik–Afghan border, which will give it a security presence in both countries. It quietly increased security assistance to Kyrgyzstan after the 2016 bombing of the Chinese embassy in Bishkek and sells weapons to Turkmenistan. China has deep interests in these four countries, generally considered to be the least stable in the region. Three of them border China, while Turkmenistan is heavily indebted to Beijing and is China’s main supplier of gas.

The Russia–China partnership in Central Asia remains generally stable for now. China’s deft diplomacy towards Russia — along with both states’ desires to keep the West out of their common backyard — has kept tensions behind closed doors. But with China now recognising it may need to strengthen its security posture in the region, it is unclear how long this stability will last.

Paul Stronski is a senior fellow in the Russia and Eurasia Program at the Carnegie Endowment for International Peace.